It’s a pretty good time to be an entrepreneur in Atlantic Canada. A decade ago there were only a couple of firms investing in startups. Now, however, there are over a dozen firms based here. Let’s take a look at these VCs in Atlantic Canada.

The New Brunswick Innovation Foundation (est 2003) is an independent, private organization focused on venture capital and research funding. They help New Brunswick innovators solve globally relevant problems through research, solid advice and access to capital.

Website: www.nbif.ca

Innovacorp (est 1995) is Nova Scotia’s early stage venture capital organization. They work to find, fund and foster innovative Nova Scotia start-ups that strive to change the world. Early stage investment is at the core of their business model. They also give entrepreneurs access to world-class incubation facilities, expert advice and other support to help them accelerate their companies.

Website: http://innovacorp.ca

BDC Capital exists to help turn great ideas into great companies. And similarly, great companies into engines of jobs, growth and wealth creation. In fact, they are Canada’s largest and most active venture capital investor.

Website: https://www.bdc.ca/en/bdc-capital/

Build Ventures (est 2013) is a Venture Capital firm that provides early stage capital to emerging Atlantic Canadian technology companies. The company is managed on behalf of its Limited Partners by Patrick Keefe and Rob Barbara.

Website: http://www.buildventures.ca

![]()

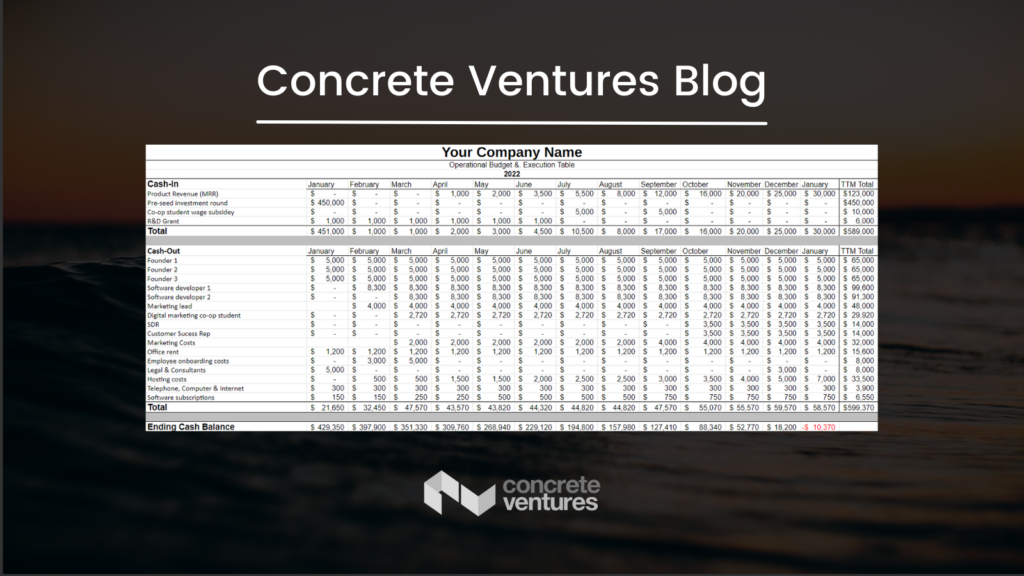

Concrete Ventures (est 2018) finds great ideas and founders in Atlantic Canada that are ready to build massively scalable businesses and work with them to grow their businesses.

Website: http://www.concrete.vc/

Sandpiper Ventures (est 2020) provides a platform where women investors and founders can radically disrupt the venture capital environment.

Website: http://sandpiper.vc/

East Valley Ventures (est 2011) is a community of innovative entrepreneurs in the business of transforming early stage ideas into successes. They help passionate Atlantic Canadian founders launch meaningful and enduring technology companies.

Website: http://www.eastvalleyventures.com/

![]()

Killick Capital Inc. (est 2004) is a leading Atlantic Canadian Private Equity firm, dedicated to partnering with Atlantic Canadian businesses and Global Aerospace businesses. Specifically, they focus on identifying and funding investments with the potential for substantial growth, long-term value creation and capital appreciation.

Website: http://www.killickcapital.com/

![]()

Pelorus Venture Capital Ltd. (est 2015) is a Venture Capital fund focused on Newfoundland and Labrador. They invest in pre-seed innovation companies with founders who disrupt and develop their bold ideas.

Website: https://www.pelorusvc.com/

Island Capital Partners is an early stage venture capital fund that is in the business of investing in high potential Prince Edward Island entrepreneurs and startups.

Website: https://www.peislandcapitalpartners.com/

Tidal Venture Partners is a pre-seed to seed + fund focused on the emerging ecosystem of Atlantic Canada. They back small teams with high potential, who have detailed plans for achieving larger, later stage milestones. They are interested in bold ideas backed by action.

Website: https://tidalventurepartners.com/

![]()

Cape Breton Capital Group (est 2022) is one of the newest VCs in Atlantic Canada. They invest in early stage startups and support succession planning of businesses in Cape Breton.

Website: http://www.capebretoncapital.com/

LongShot Capital (est 2021) invests in early stage tech companies that are raising rounds of $300k-$1M. They invest with other angels, strategic and VCs, but they do not lead.

Website: http://www.longshotcap.com/

![]()

Natural Products Canada (est 2016) is a not for profit focused on Canadian natural product innovations that can replace synthetic products to benefit people, animals and the planet. They provide a one-stop shop for strategic insights, programs and services to anyone looking to participate in Canada’s natural product industry.

Website: http://naturalproductscanada.com/

Additional VCs in Atlantic Canada:

Are there any VCs we missed? Let us know in the comments.