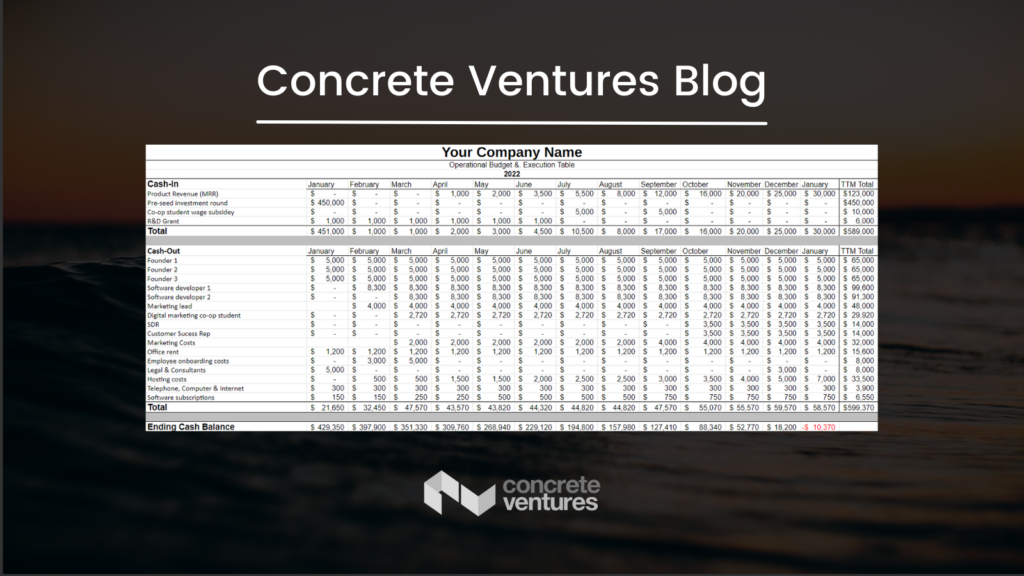

We created a template that covers everything discussed in our how-to post. Filled with sample data for an imaginary startup so you can take the time to understand how cash flows through the business and eventually translates into progress towards milestones.

This template is an over-simplification designed to drive home the point that cash is the lifeblood of your startup. Fill it with your own information and add what you need so you can get a clear picture of what’s driving your business.

Concrete Ventures Pre-Seed Financial Model Template

If you’re looking to level up your financial model, then check out some of these financial model templates below:

SaaS Financial Plan v2.0 by Christoph Janz

Use this tool to:

- Create a simple plan for an early-stage SaaS startup with a low-touch sales model

- Includes support for multiple pricing tiers

- Supports annual contracts with annual pre-payments

- Great headcount planning section

- Simple cash-flow planning

- Plenty of built-in charts

Limitations

- Revenue/cost-based model (no balance sheet)

- Month to month only (doesn’t account for annual plans paid up-front)

SaaS Financial Model, by Jaakko Piipponen

Use this tool to:

- Upgrade your SaaS Financial Model to an operational tool that helps you make more informed decisions.

- Build scenario-based forecasts to get ahead of the data instead of reacting to it.

- Includes loans & investments

Charlie Tillet Financial Template

Use this model to track:

- P&L by year and quarter

- Sales Plan

- COGS

- Staffing plan

- Expenses

- Balance Sheet

- Capex and Cashflow

- Which lets you account for investment

Cash Flow Projection Tool for Tech Companies | BDC.ca

Use this tool to:

- Present past financial results and project cash flow for up to 24 months into the future

- Automatically generate key SaaS metrics, for example churn rate, monthly recurring revenue, and customer lifetime value

- Present financial information and growth forecasts to investors, bankers, and other partners

Use insights from the cash flow projection tool to:

- Understand the amount of additional funding you need to keep your tech company on the right growth trajectory

- Highlight shareholder investments and other financial inflows, such as grants, when applying for loans

- Keep track of key SaaS metrics, such as MRR and churn