We find great ideas and founders in Atlantic Canada that are ready to build massively scalable businesses and work with them to grow their businesses.

More than just capital...

Founder's Pack

Negotiated rates and discounts from all the tools and services to get your startup moving.

Playbooks

Founder designed playbooks to help you with your startup’s most pressing needs, right when you need it.

Council

Learn from your peer CEOs & founders in our quarterly council meetings.

Path Forward

A designed path forward to help you succeed on your venture capital journey.

Education

Webinars, content, and connections to industry experts to amplify your growth.

Access to Talent

We support your hiring by connecting you to highly talented individuals.

Connections

We know people who know people. Our investors are some of the region’s top tech entrepreneurs.

Long-term Investor

We are in it for the long haul and are here to support you on your startup journey.

Driven to Grow

We know what it takes to grow your startup and are committed to help you reach your goals.

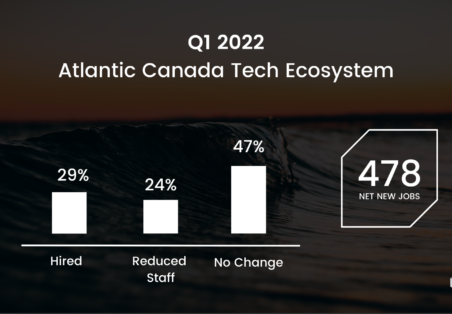

Building tomorrow's tech titans

All the tech titans of tomorrow start off with small, passionate teams that demonstrate unique insights into their industry. They have the drive and the passion to build something big. This is where we start our partnership.

True value-add investors

We believe in going above and beyond our initial investment. Our team has the experience and the connections to help throughout all phases of your startup journey. We believe in a lasting partnership that sees you through all the critical challenges that early startups encounter.

By founders, for founders

We know the challenges you face as founders because we’ve been there! We operate our fund with the same scrappy and innovative spirit we had when we were founders ourselves. We are driven to deliver value to you at all levels and help maximize your growth with a thoughtful and creative approach.

Want to work for one of our portfolio companies?

Apply to our Talent Database